In a shocking development backed by judicial orders and documentary evidence, Sashidhar Jagdishan, Managing Director & CEO of HDFC Bank Ltd., has been named in a court-directed FIR for allegedly misusing his position to commit grave financial fraud, criminal conspiracy, and obstruction of justice—causing irreparable harm to the Lilavati Kirtilal Mehta Medical Trust (LKMM Trust), a registered public charitable institution.

This is not an indictment of the bank itself, but of a powerful individual accused of exploiting his executive role to unlawfully benefit a group of now-ousted trustees, at the cost of public interest and charitable integrity.

Judicially Directed FIR Exposes Financial Fraud and Bribery

FIR No. 818/2025, registered on 30th May 2025 under explicit direction from the Hon’ble Magistrate Court, reveals a disturbing paper trail:

- A seized handwritten cash diary records ₹2.05 crore in unaccounted payments made directly to Mr. Jagdishan.

- ₹25 crore of Trust funds were illegally deposited into HDFC Bank without board approval.

- Bribery attempts of ₹1.5 crore, masked as CSR donations, were allegedly offered to hospital staff to suppress or destroy records.

- Medical waivers and VIP treatment at Lilavati Hospital were reportedly extended to Mr. Jagdishan and family, allegedly in exchange for his complicity and silence.

These revelations were not disclosed to HDFC Bank’s Board, SEBI, or investors—despite their clear material impact.

Exploitation of a Charitable Institution

The Trust asserts that Mr. Jagdishan enabled and protected a rogue group of ex-trustees in siphoning funds, obstructing investigations, and harassing whistleblowers. Most tragically, 84-year-old Founder and Permanent Trustee Shri Kishor Mehta was served over 100 legal summonses and allegedly subjected to mental torture before his death.

The alleged role of Mr. Jagdishan wasn’t passive. According to evidence, he is believed to have:

- Facilitated illicit transfers of Trust assets

- Deliberately withheld key banking records

- Actively blocked internal scrutiny of suspect transactions

- Suppressed regulatory disclosures

A Broader Pattern of Criminal Conspiracy

The FIR is part of a larger matrix of financial crimes involving over ₹1,353 crore in embezzled Trust funds:

- FIR No. 972/2024 – ₹11.52 crore siphoned from Trust corpus

- FIR No. 1916/2024 – ₹85 crore misappropriated under pretense of legal fees routed to shell firms

- FIR No. 375/2025 – ₹1,243.09 crore fraud in procurement of medical/pharmacy equipment

Yet, it is FIR No. 818/2025 that directly implicates Mr. Jagdishan for personally benefiting from illegal payments and facilitating cover-ups—raising grave concerns under Sections 406, 409, 420, and 34 of the IPC.

Violations and Grounds for Immediate Action

As per the Trust, the allegations trigger multiple legal and regulatory violations:

- Violation of RBI’s ‘Fit and Proper’ Guidelines: Active criminal charges disqualify Mr. Jagdishan from continuing in any banking leadership role.

- Breach of SEBI and Companies Act norms: The material non-disclosure of judicial FIRs undermines shareholder and public trust.

- Criminal Breach of Trust and Obstruction: Offers of CSR-bribe and tampering with Trust funds constitute prosecutable offenses.

Urgent Demands from the Trust

LKMM Trust has called upon the Board of HDFC Bank, RBI, SEBI, and the Finance Ministry to take immediate and corrective action:

- Suspend Mr. Jagdishan from all official duties and board positions pending investigation

- Initiate a forensic audit of all transactions involving HDFC Bank and the Trust during his tenure

- Freeze personal and associated assets of Mr. Jagdishan

- Disclose all legal expenses borne by HDFC Bank in his defense

- Bar Mr. Jagdishan from holding any office in SEBI-regulated entities

- Ensure full whistleblower protection to employees and witnesses supporting the investigation

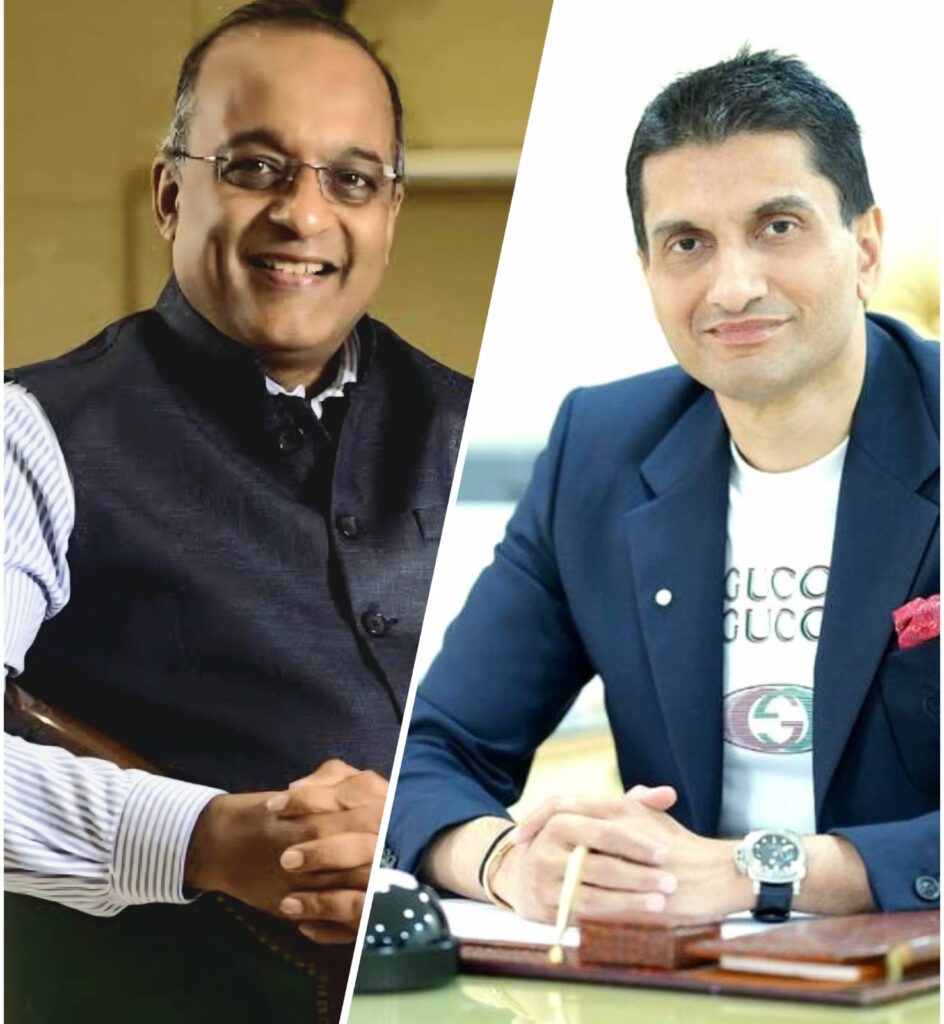

“This is not a business dispute. It is a criminal betrayal of public trust and charity funds by an individual who misused the prestige and platform of a leading bank to protect wrongdoers and suppress the truth. Mr. Sashidhar Jagdishan must be removed immediately to allow the law to take its course,” — said Shri Prashant Kishor Mehta, Permanent Trustee, LKMM Trust.