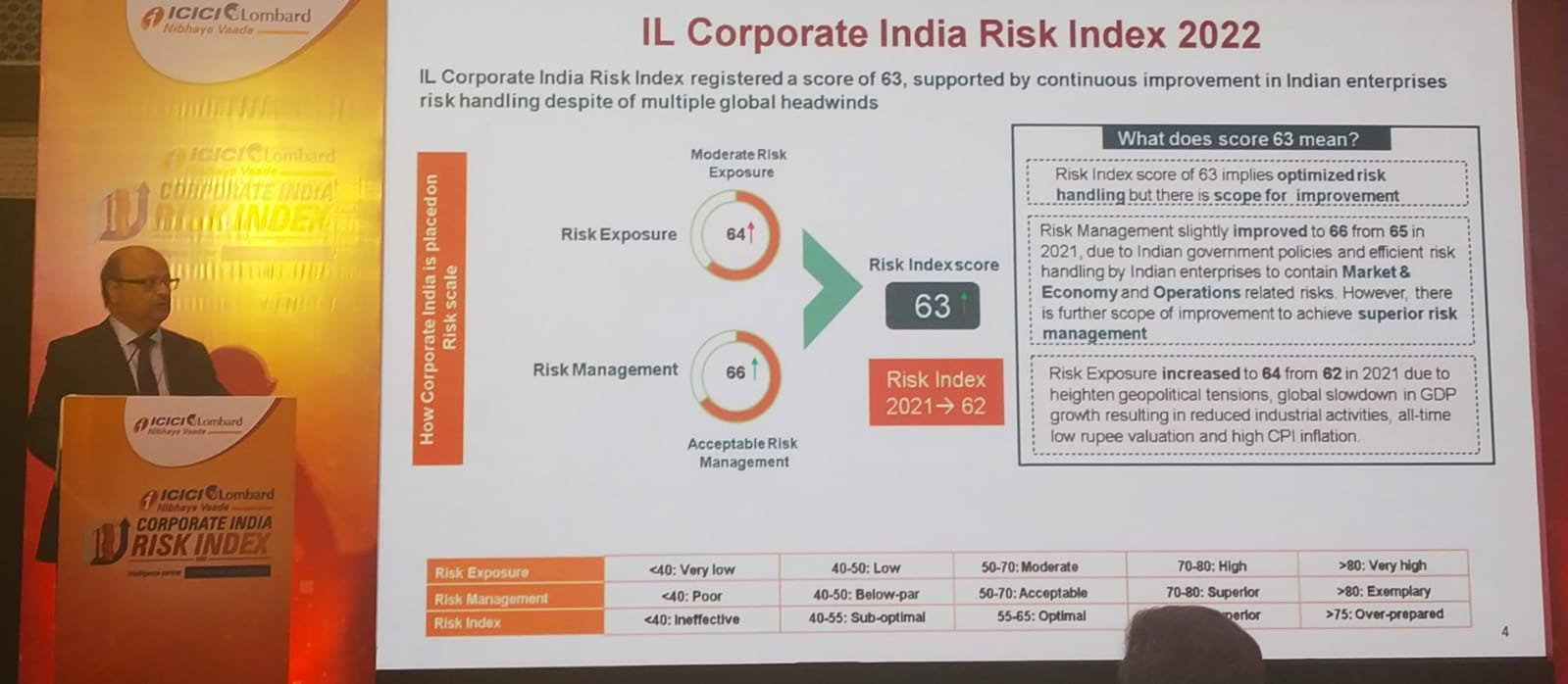

~ Corporate india Risk Index registered a score of 63, supported by continous improvement in Indian enterprises risk handling despite of multiple global headwinds.~

Despite facing challenges such as tightening global monetary policies, rising inflation, slowing global growth, and elevated commodity prices, the Indian government and corporates have demonstrated resilience by employing efficient risk management strategies.

The 3rd edition of the Corporate India Risk Index (CIRI) 2022, a proprietary study conducted by ICICI Lombard in collaboration with Frost and Sullivan, shows a rise in the risk index score from 62 in 2021 to 63 in 2022. ICICI Lombard India’s leading private general insurer has been a pioneer and thought leader in creating first-of-its-kind risk index for India Inc and India Risk Management Awards (IRMA), a property for recognizing organizations for their risk governance practices.

ICICI Lombard’s CIRI 2022 comprises 32 risk elements across 6 broad dimensions and draws upon global risk management best practices. A higher score signifies better risk management, enabling companies to adopt effective risk management practices.

Mr. Bhargav Dasgupta MD & CEO of ICICI Lombard along with Mr Aroop Zutshi, Global President of Frost & Sullivan spoke at the CIRI 2022 launch event today. At the 9th Edition of the India Risk Managament Awards, ICICI Lombard also recognised and felicitated over 250 corporates from large and medium sector who have demonstrated exemplary risk management values.

Rising Risk Index Indicates Better Risk Management Among Indian Companies

| Key Factors Comparison | 2022 | 2021 | 2020 |

| Corporate India Risk Index | 63 | 62 | 57 |

| Corporate India Risk Management | 66 | 65 | 64 |

| Corporate India Risk Exposure | 64 | 62 | 66 |

Commenting on the launch, Bhargav Dasgupta, MD & CEO, ICICI Lombard, said, “The ICICI Lombard Corporate Risk Index report provides the insights and tools necessary for companies to evaluate and manage their risk profiles, empowers them to navigate adversity for long-term and sustainable growth. The enhanced score in the 3rd edition of the Corporate Risk Index is a testament to the efficient risk management practices adopted by Indian corporates in the face of global headwinds and challenges. As we move forward, it is crucial for companies to stay ahead of the curve and adopt comprehensive and efficient risk management practices.”

Aroop Zutshi, Global President, Frost & Sullivan, said, “Strength of India’s story lies in the fact that Corporate India Risk Index score is steadily improving YoY, we are seeing a larger number of sectors moving towards a better Risk Index such as Telecom & Communication, Aerospace & Defense and Education & Skill Development. It is also observed that Large and Mid-size Indian enterprises are getting resilient and managing else transferring Market & Economy and Operational related risk arising from geo-political issues with a level of maturity which is indicating towards India’s journey of safeguarding its interests in an ever-changing risk world.”

1 comment

Reblogged this on INDIANS AROUND THE WORLD.